Most entrepreneurs understand that driving repeat business is critical to their company's success. But it can be tempting to chase the short-term revenue spikes brought by new customers instead.

The growth opportunity some entrepreneurs miss is they neglect a customer as soon as they’ve completed their order. In fact,33% of shoppers saythat they wouldn’t buy from a brand again after just one negative experience.

If you’re looking to build sustainable growth, you have to shift your focus from acquisition to retention and scale your efforts across the customer lifecycle. The key is measuring customer lifetime value (LTV), defining your best customers, and creating an engaging brand experience for them.

LTV is the metric for identifying your best customers

LTV, or customer lifetime value, is the metric that shows you the total value of a given customer over a lifetime of interactions with your brand.

Customer LTV= Customer Value x Average Customer Lifespan

Let’s say you’remeasuring the LTVof two different customers. To do this, you’ll need to know the average customer lifespan. The lifespan of a customer is measured as the time between their first purchase and the time they become inactive and stop making purchases from your store. And for this example, we’ll say your average customer lifespan is about 3 years.

You’ve just acquired Customer A, who has spent $200 on a single order from your store. Youraverage order valueis $75, so this seems like an exciting win from an acquisition standpoint.

Customer Value= Average order value x Purchase frequency

Customer A’s value= $200 x 1= $200

By the end of the year, you notice Customer A has only placed one order and isn’t engaging with your brand anymore. When you look into the data for another customer (Customer B), you see that they bought from you 3x this year. Each sale was $75, but because they have had repeated, positive engagement with your brand they’ve bought more often—and provided more revenue than Customer A!

Customer B's value= $75 x 3= $225

Not only that, but Customer B spent the same amount each of the 3 years they have shopped with your brand. This means that the LTV of Customer A is $200, whereas Customer B is $675.

LTV of Customer A= $200 x 1= $200

LTV of Customer B= $225 x 3= $675

After measuring LTV, you know that more frequent purchases will create the most revenue for your store. So you decide to re-engage Customer A to encourage a second order. And you also want to strengthen your relationship with Customer B by continuing to satisfy them each time they engage with your brand.

Products acquire customers, your brand retains them

While a good marketing andsales strategycan deliver your first sale with a customer, it's only the beginning of your relationship—and their revenue potential.

Acquisition is important, but it’s not the most sustainable path towards growth because it’s so difficult to scale. Acquisition relies on convincing a new and unknown group of people to choose your product or service over any other available and, without an existing relationship, it's hard to persuade them to do so. Plus, with theincreasing cost of acquiring new customers, it’s also more expensive.

Brand is your tool to drive retention. Your brand is not just a logo or color scheme—it’s how people perceive you. This means your customers’ entire experience, from discovery to re-purchase, shapes how they feel about your brand.

Each customer has given you the opportunity to make their experience a positive and long-lasting one—and it shouldn’t be taken for granted. After all, it’snearly impossible to retain a customer who has already churned. Thinking through how youcommunicate with your customers at each touchpoint in their journeyis a great place to start building your brand, and ultimately, retaining your best customers.

Merchant Example:

Allbirds’ brand is known for its shoes and sustainability. But Allbirds' customers don’t believe their mission simply because it says so on their site. They bake sustainability into their customer experience, products, and internal values. By reinforcing their brand at every step, Allbirds both attracts and retains the customers they want.

Customer lifetime value begins with their first order

Consider your customers’ decision to buy from your brand the first time. They likely saw an ad or recognized a need that could be fulfilled by purchasing your product or service. They may have seen multiple ads, read reviews, or considered one of your competitors before making their decision.

Once they chose your brand, they selected a product, added it to their cart, and entered their payment details. They may have created an account tosimplify their checkout processfor this and future purchases.

Many businesses would view this as a successful sale, however, your customer is only halfway through their journey. They have yet to receive or enjoy the product they purchased. Your brand is still making its first impression, and there are many touchpoints after checkout that can make or break a second sale.

LTV is influenced by the complete customer lifecycle. This is why brands who are intentional and consistent at each phase are able to cultivate loyal and engaged customers.

How to start improving LTV today

Acquisition serves as an entry point to your customers’ relationship with your brand—retention drives growth by adding depth to that relationship.

One of the easiest ways to boost LTV is todesign a post-purchase journeythat offers a personalized experience to your new and repeat customers.

You've likelycustomized your order confirmation page and emailsthrough your Shopify store, but if your post-purchase communication stops there, you’re leaving a lot of your brand engagement up to chance.

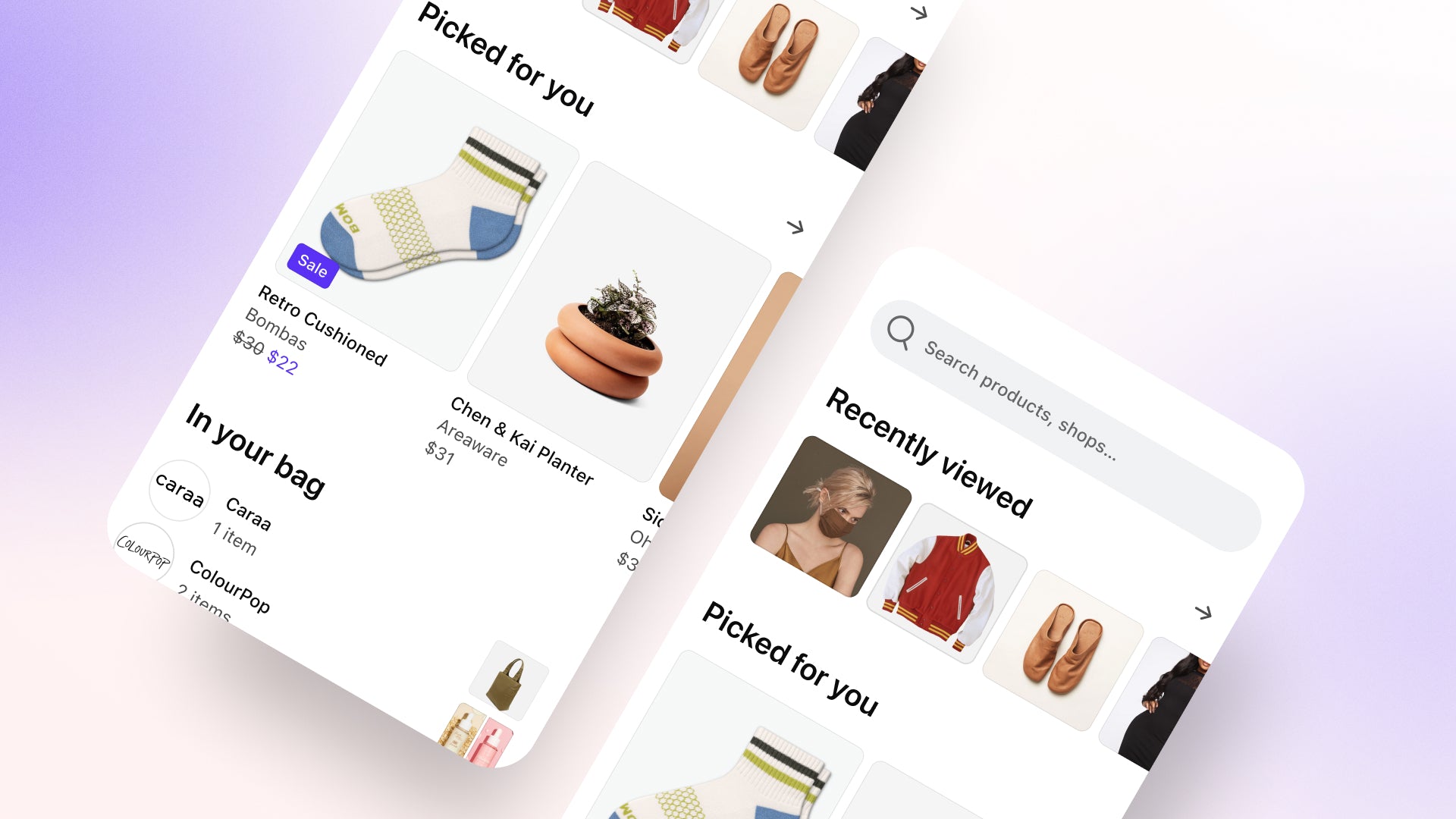

Tools like theShop channel by Shopifyis a direct line into your customers’ mobile devices via the Shop app. As more people arespending more time on their devices than ever before, the Shop app is their go-to source for tracking orders and discovering new products from the stores they follow. As Shop serves shoppers recommendations based on their past purchase behavior, your brand stays front and center with your customers every time they open the app.

On average, approximately 32% of a Shopify merchant’s customers are already Shop app users. This means that potentially ⅓ of your customers are already using Shop to engage with your brand.

If you have theShop channelinstalled on your store’s admin, it’s easy to see how many of your customers are using the Shop app already. You can use this mobile real estate to tailor personalized offers and timely updates to elevate your brand experience after the sale. And the best part is Shop is free.

Brands that offer a complete experience across the customer lifecycle are better able to retain their best customers long term. On the other hand, an inconsistent brand, or one that neglects their customer after the sale, will find their customer loyalty lacking. Every touchpoint before (and after) their order is placed is an opportunity to shape and deepen their impressions.

To start creating your own post-purchase journey,sign up for the Shop newsletterand stay tuned for more tactics on scaling LTV through the holidays.