Camille Newman has never relied on handouts.

She’s a first generation American, born in Jamaica before moving to the States as a child. From her immigrant parents, she learned the value of hard work and building her dream without help from family or friends. She funded her business with savings, pitch competitions, and micro-loans. And she's aglobal ecommerceentrepreneur.

Pop Up Plus, Camille’s ecommerce fashion business, sells dresses and confidence to plus size women.Funding held her backfrom opening a permanent retail store with New York’s sky-high commercial leases, so she launched on a pop-up model, later moving online.

She tells me of future plans to monetize content, bring manufacturing in-house, and convert a truck into a mobile shop. She has more ideas than money to implement them.

Funding remains one of thebiggest barriers to entrepreneurship.With half of all businesses failing within five-years, and only a third making it to 10 years, banks are naturally conservative with lending.Financial illiteracy and inability to pay billsrank high on the reasons most don’t make it to their 10th birthday.

Traditionalloans being out of the question, many new entrepreneurs like Camille are seeking alternative funding. A quick read onhow to get a business loanwill help you get started with funding your small business.

Funding remains one of the biggest barriers to entrepreneurship.

Shopify Capital

When an influencer partnership turned into a major feature in a wedding magazine, Camille scrambled to get inventory to meet demand.

She needed cash, and fast.

That same day, when she logged into Shopify, she saw a notification introducing her toShopify Capital.偶然的时机鼓励卡米尔pply, despite her hesitations about borrowing. But she found that the process was simple—just a few clicks—and lacked the complexity usually associated with traditional loans.

Shopify Capital provides access to flexible funding to qualifying merchants. Your store’s sales history is used to determine your eligibility and there’s no lengthy application process. After you review your funding options and are approved, funds are deposited directly into your bank account.

Remittance, designed for the ups and downs of small businesses, occurs automatically from a percentage of your daily sales (higher when your sales are strong and lower when things slow down).

Since the launch of Shopify Capital, we’ve provided access to over $20 million to help US small business owners like Camille meet their goals.

Pop Up Plus had a tough patch this summer, Camille tells me, and the remittance terms have been a relief.

“Shopify Capital was the life line my business needed this summer. As you can imagine, when you have a business where you have to maintain inventory, maintaining consistent positivecash flowbecomes a challenge. So many things are dependent on sales. [Funding through] Shopify Capital has been very easy, very straightforward. You have a dashboard that shows your progress. I have to tell you, I have never had financing that was this simple.”

Shopify Capital was the life line my business needed this summer.

How to Fund Your Small Business

Major financial institutionsapprove approximately 23% of small business loan applicationsin the US. So how are entrepreneurs finding money?

If you don't qualify for Shopify Capital, here are eight other alternatives to traditional loans:

- Bootstrapping: reinvest profits back into your business. Listen:How Barbell Apparel Bootstrapped Their Business[Podcast]

- Family and Friends: don’t discount your network as a potential place to borrow for your business

- Angel Investors: funding from an individual usually in exchange for equity. Read:The Unlikely Story of the Activist Who Shook up the Fashion World

- Crowdfunding: raise money from many individual investors (through sites like Kickstarter or Indiegogo), usually in exchange for “rewards or perks”. Read:The Ultimate Guide to Crowdfunding

- Equity Crowdfunding: similar to crowdfunding, except that the rewards or perks are equity in the company. Read:Tired of the Banks Turning you Down? Try This Instead

- Venture Capital Financing: private capital provided as seed or growth funding by a VC firm in exchange for equity in the company

- Incubators andBusiness Accelerators: organizations that provide education and support to new businesses, sometimes offering micro-loans

- Pitch Competitions: pitch your idea to a panel of judges for a chance at prize money to launch or grow your business

Free Reading List: Ecommerce Motivation

Having trouble focusing on growing your small business? Get access to our free, curated list of high-impact productivity articles.

Get our Ecommerce Motivation reading list delivered right to your inbox.

Almost there: please enter your email below to gain instant access.

We'll also send you updates on new educational guides and success stories from the Shopify newsletter. We hate SPAM and promise to keep your email address safe.

Meet Pop Up Plus

Pop Up Plus, an ecommerce and pop-up concept carrying trendy apparel in 14+ sizes, was born out of Camille’s own struggle with body image and shopping for her size.

“I had always been a curvy girl, particularly in college, the freshman 15 became the freshman 70. While I was searching for clothing everywhere, I discovered that not only did I gain a lot of weight, but retailers at that time weren't catering to my size. I remember the awful feeling I felt when I was stuck in the fitting room and nothing fit. That’s when I decided that no other woman should ever be made to feel that horrible ever again.”

I was stuck in the fitting room and nothing fit. That’s when I decided that no other woman should ever be made to feel that horrible ever again.

When the recession hit and she was laid off from her job, she decided to pursue her idea of opening aretail shopin Brooklyn. The dream and the reality, she soon realized were separated by money—alotof money that she didn’t have.

“I took a business class with an organization calledCAMBA.They tried to help small businesses—minority small businesses especially—get started. This gentleman reviewed mybusiness planand told me it was so eloquently written. He asked, ‘Do you have the $100,000 to get the boutique started? Do you have collateral?’ I was like, ‘No. I guess we're going to go back to the drawing board.’ That's when a new trend of pop up shops was emerging. I decided that since I couldn't raise $100,000 to pay for rent, have cash flow, and everything else, we would start as apop-up shop.”

In 2010, Camille launched the firstpop-upwith a micro-loan from CAMBA. The shop garnered a wave of press. Though she didn’t break even after the first round, the shop did well and Camille continued to grow the pop-up model for the next four years.

I decided that since I couldn't raise $100,000 to pay for rent, have cash flow, and everything else, we would start as a pop-up shop.

The resistance towards ecommerce came from her own experience and feedback from other women, but then she noticed that the industry began to change.

“Plus sized women have always said, ‘I want to try stuff on.’ I thought that a pop-up was the best way to go, instead of an online shop. Then I realized that most plus-sized stores was carrying stuff online. I realized that the customer was being trained to shop that way. That’s when I decided to pivot to a online store in the fall of 2014. We've been on Shopify ever since."

The shift was also necessary as the popularity of her New York pop-ups began to diminish. In an industry as fickle as fashion, she saw the importance of being nimble.

“The pop ups now make up only 20% of the business. Fashion is so hard. You get on a trend and then everybody kills the trend for three or four years and people move on. I was finding that excitement around our pop up shops started to wane a little bit. Then the need to overproduce pop up shops became necessary. ‘Can we put in an ice cream shop and a photo booth? How can we make this pop up really grand?’”

Fashion is so hard. You get on a trend and then everybody kills the trend for three or four years and people move on.

A Pop Up Plus retail event, photo:Style Over Size

She now runs the online store with a lean team of just two other people—one who handles shipping and logistics and another who is responsible for the website and content.

“We’re a small team because I've been in fashion for a very long time. I've just learned that you have to keep your costs very low and operate as lean as you can. I'm definitely trying to expand. I won't expand to where the business is in the red continually. That's why I haven't hired a whole bunch of people yet.”

She also relies on interns to help her through the busy surges. Hiring interns has been valuable for the business, to help her connect with her younger customers.

“Interns have been invaluable in helping us identify the needs of our customer. We happen to attract plus size interns—it's valuable to hear from them as a shopping experience. Learning how to provide content to get the customer to shop has been a goal for me this year. The interns are Snapchat obsessed. I have to be very honest, I'm 37 and I just don't get it. That is a perfect example of how having younger interns just really helps.”

Every spring, Pop Up Plus runs anAll White campaign.It’s a move that’s been fruitful for the company in past years, but Camille has noticed an increase in other companies running similar campaigns. As a result, she was stuck with inventory that wasn’t moving.

One specific dress from the promotion wasn’t selling, so she marked it down to $24.99 andsent one to a style influencerto help get it some traction. It worked.

“I woke up in the middle of the night because of all of the Shopify order notifications on my phone. I got up and changed the price back then called the vendor and asked, ‘How many of these do you have?’ I wasn’t going to take all 150, so I bought 30. Literally, those 30 dresses sold out within a day and a half. I had no idea what was happening. The blogger contacted me and she said, ‘Did you see the dress got featured on a wedding site?’ I called the vendor and told her to send me every piece she had. Within a week and a half, we sold out again. As we speak, a customer just emailed me about this same dress. I probably could have sold 400 of them.”

我打电话给供应商,告诉她给我每一个piece she had. Within a week and a half, we sold out again.

Pop Up PlusInfluencer Campaign

It was pure coincidence that she spotted the notification forShopify Capitalthe day before she needed topay up front for the inventory.

"If you’re a fashion business and you're buying from these wholesalers in Los Angeles, you have to be a huge company to get net terms. Small businesses have to pay up front. Shopify Capital rescued us big time. Of course, I could have put it on my credit card but I was trying not to go there. I save it for other things that could be an emergency. I try to keep everything within my business. We borrowed $8000. In a matter of hours, the funds were in my business account. It was so fast."

Of course, I could have put it on my credit card but I was trying not to go there.

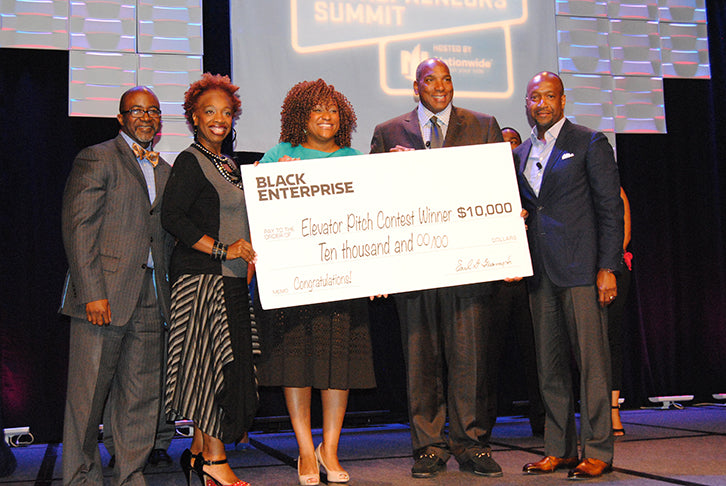

Funding, Camille tells me, has been her number one barrier to growing her business. For the last five years, Camille has self-funded, mainly through pitch competitions and her own savings. She recently won $10,000 at one pitch and estimates that she’s made roughly $60,000 in total through various competitions.

“Every time I meet a small business, it's the same issue: funding, funding, funding. So, I’m always pitching. I find competitions just by Googling, but after a while, it becomes a group of people that move from competition to competition. I think I've exhausted all the black ones. Now I have to move on to the global ones. I've won theNational Urban League,Black Enterprise, andNational Black MBA Association.”

Camille Newman at the Black Summit Pitch Competition, photo:Talking With Tami

The Plus Industry

Camille understands that she’s selling more than just a dress. She’s selling a service. She’s selling confidence and empowerment. In plus fashion, she tells me, community is critical. Not only are there unique garment construction requirement, fit challenges demand a higher level of customer service, and an intimate relationship with the customer.

She is currentlysourcing her dresses from wholesalersin LA, while manufacturing some pieces locally under her own label. Because fit differs from manufacturer to manufacturer, and even between individual pieces, fit has been a huge challenge.

“Most manufacturers are using a fit that they developed around World War II. It's crazy. They’re using old measurements and building on top of that. There’s just so much work that really needs to go into fit. We try to resolve that by telling the customer how it fits on that particular model, then telling them what to buy if they're a certain size. I also try to buy as many items as I can with stretch. For my customer it's just a necessity.”

As she grows her business, her eventual hope is to move all manufacturing in-house, to have more control over fit and consistent sizing guidelines.

“I think that the fashion industry is behind in commonizing sizes and fit. It's going to rest on small businesses to start that movement and do it individually.”

photo:Brokelyn

Funding Growth

In her former career, Camille worked for a competitor plus brand, and saw first hand how much confidence and support are woven into running a business like hers.

“At least 40% of women who came in needed that extra boost. I’d say, ‘Listen. You look good in this. Throw some shapewear on. Throw a blazer on with that. You can do this. You're beautiful.’”

Learn more:Online shopping statistics

Her experiences have inspired a new direction for the business, one that moves beyond product. She’s a natural face and voice for the brand, sharing the struggles of her customers. Her charisma has helped her win pitch competitions, and she’s leaning on her history of motivating women through purchases to begin tomonetize the message behind her brand through content.

"We just need to transition the way we do commerce. I've been kicking around the idea of body image webinars or confidence classes. You never know who might take it. Personally, I’m working on body image myself. I know that a lot of women out there are probably still struggling with that same thing. If the webinar is $10 and we get 100 people attending, that's money that we can propel into the business. I want to build a loyal following beyond clothes, because I think there's fast fashion fatigue happening. I have to be very honest: I love what our product does for people more than the product itself. The company is heading more into body image and self love. How we get there is what I'm still trying to figure out.”

I love what our product does for people more than the product itself.

Camille has also not quite abandoned the pop-up concept. It is, after all, built into the name of the business. She realizes the idea is overdue for a refresh and she’s already plotting her next move:a mobile shopthat will take her products and body-positive message to women all over America.

She hopes to take advantage of funding through Shopify Capital again to help fund the project, and is exploring the idea ofcrowdfunding, too.

“I have this crazy idea for a mobile pop-up. There was a Ford representative at the latest competition. Since I like to get as much free stuff as I can, I thought, ‘What if I just pitched Ford?’ So I’m going to do that, but if that doesn’t work, I'm going to definitely fundraise. I would love to get a tour going next summer and roll to all of the spots where we have a huge customer base: Philly, DC, Virginia, definitely North Carolina and Florida. It would be great for content because we could do a lot of video. We actually discussed getting a GoFundMe going!”

Kate Spade移动boutique, photo:Dans ta Pub

Camille has had her share of downs throughout that last six years, but her ups are all her own. She started a business during a period of economic volatility in a saturated industry. Yet, Pop Up Plus passed its five year mark—a milestone that half of all businesses will never reach.

What I learned from Camille, was that true entrepreneurship means always finding a way. When the market changes, change with it. When one idea fails, have another one waiting in the wings. When one investor says no, there’s always another with a yes.

Adapt, persist, and believe in your dream.

“It has been a tough road but I believe it’s my life's work to remind women that we are beautiful and that we can look and feel great at any size!”